Job Market Paper: Social Inflation [SSRN]

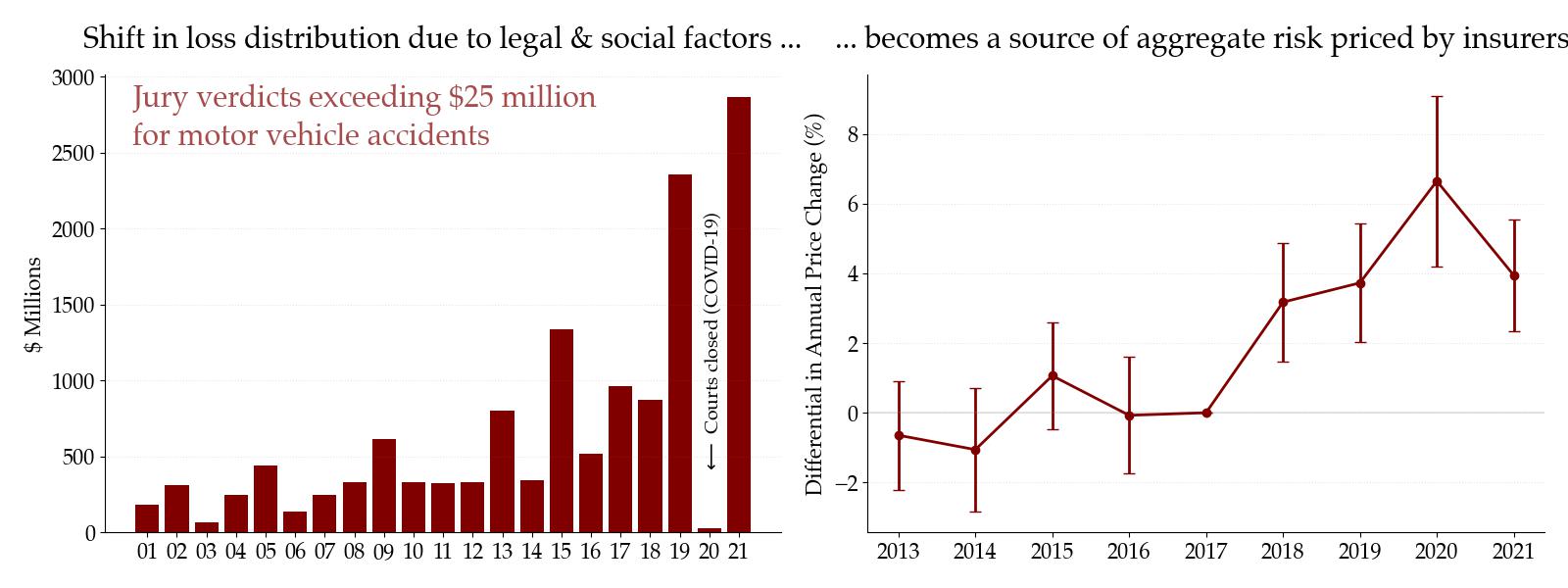

I study the pricing of a novel source of aggregate risk for the insurance sector: shifts in insurers’ loss distribution due to extreme jury verdicts and settlements, widely referred to as social inflation by insurers and regulators. A hedonic model shows that jury verdicts for accidents with identical characteristics have increased persistently since 2015, which insurers attribute to evolving social norms and legal tactics. Insurers face not only higher expected losses but also heightened uncertainty, due to both higher loss variability and uncertainty about loss distribution parameters. I then study the insurers' price response to social inflation, focusing on the auto insurance market. Leveraging within insurer-year variation across product lines and across geography, I find that social inflation accounts for nearly two thirds of the annual price increase since 2018. A model shows that this large price response includes a risk premium due to the interaction of financial frictions with uncertainty in the loss distribution. Consistent with risk compensation in insurers' price response, I find (i) higher insurer profitability, (ii) bigger hikes for more constrained insurers, and (iii) increased risk margin in loss reserves. Overall, my findings highlight how changing social norms and legal developments translate into a source of aggregate risk for the insurance sector. Uncertainty induced by the shifting loss distribution is priced by insurers, a finding that is relevant to emerging risks such as climate and cyber.

Select Conference Presentations

- NBER Insurance Working Group Meeting 2022

- Swiss Society for Financial Market Research (SGF Conference) 2022

- Western Finance Association Meeting 2021

- Eastern Finance Association Meeting 2021

Select Awards

- WFA PhD Candidate Award For Outstanding Research

- Stigler Center PhD Dissertation Award and Bradley Fellowship